The 2020 Budget on Tuesday night delivered another new term to our vernacular – JobMaker – a clear sign it is all about jobs and spending to make more jobs! Add in bringing forward the personal income tax cuts announced in last year’s budget and the Government’s very keen to put cash in peoples’ pockets now! Increasing cash -> increase expenditure -> increasing demand -> increasing job generation. An extraordinary budget for extraordinary times which has laid out our country’s pathway for recovery from COVID-19.

See our overview of the key measures and what they mean for:

Individuals and families

Retirees

Businesses

Individuals and Families

Increasing cash in peoples’ pockets

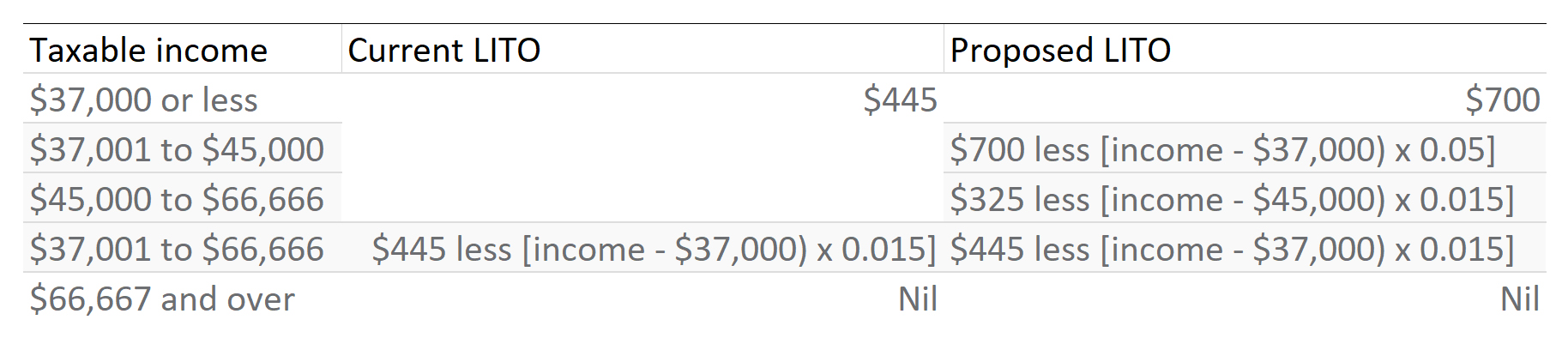

From 1 July 2020, two years earlier than legislated, the Stage 2 low income tax offset (LITO) and the thresholds for the 19% and 32.5% personal income tax brackets are proposed to increase.

LITO will increase from $445 to $700 from 1 July 2020 and the low to middle income tax offset (LMITO) will be retained this financial year.

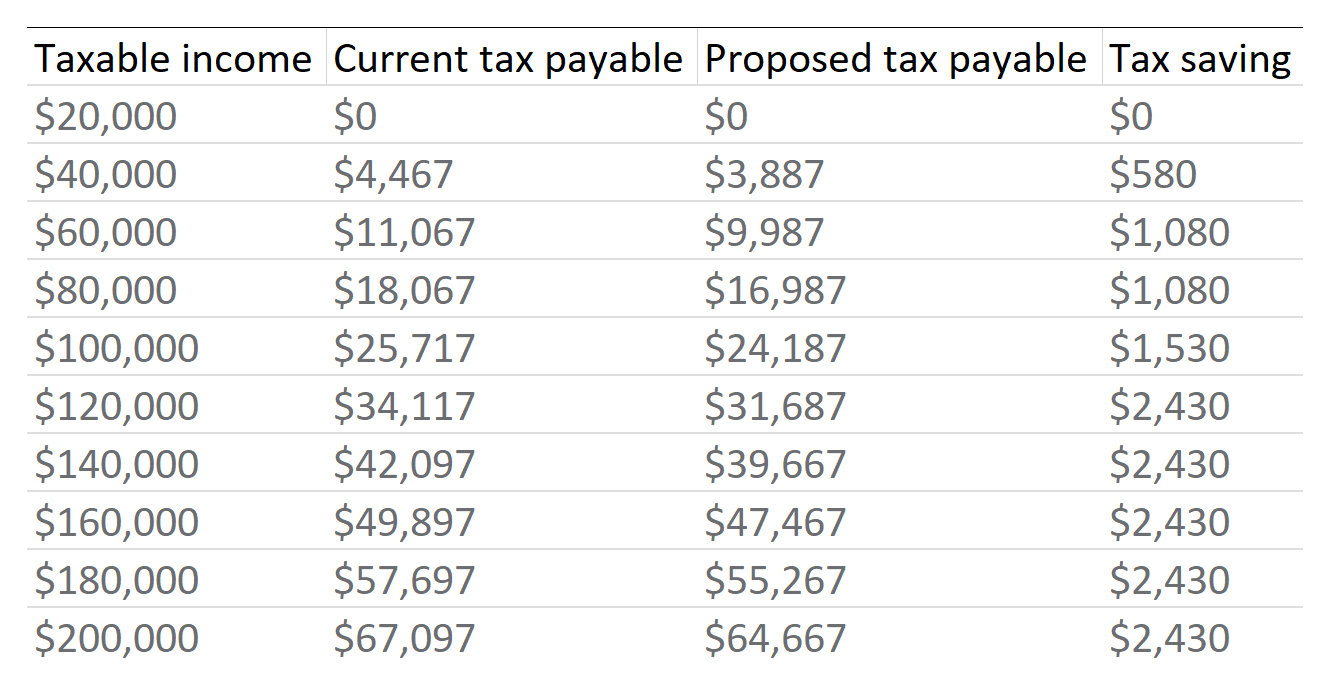

The proposed bring-forward of the personal income tax thresholds, rates and tax offsets create the following future tax savings

Paid Parental Leave work test

The Paid Parental Leave work test required for births and adoptions that occur between 22 March 2020 and 31 March 2021 will reduce the number of months parents need to work from 10 of the last 13 months to 10 of the last 20 months.

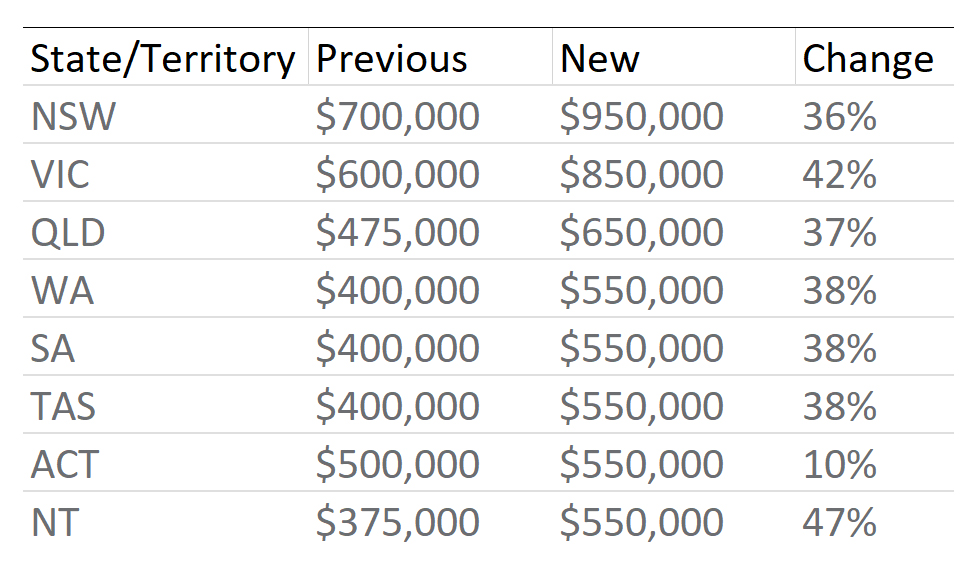

Extension of First Home Loan Deposit Scheme

The First Home Loan Deposit Scheme will be extended to provide an additional 10,000 guarantees in 2020/21 to allow eligible first home buyers to build a new home or purchase a newly constructed home sooner with a deposit of as little as 5%.

The price cap will also be significantly increased which should see the scheme broaden out to new regions and postcodes.

Incentives to encourage students to undertake seasonal work

To help our farmers with seasonal work such as fruit picking, and to encourage younger individuals to work, the Government is proposing the introduction of a temporary pathway for young people who currently receive Youth Allowance (Student) or ABSTUDY. This will allow an individual to be considered independent if they earn at least $15,000 in the agricultural industry between 30 November 2020 and 31 December 2021, and they currently meet parental income testing requirements.

Retirees

Increasing cash in peoples’ pockets

In addition to Stage 2 low income tax offset (LITO) and bringing forward the thresholds for the 19% and 32.5% personal income tax brackets (see individuals and families), for those eligible, two tax free economic support payments of $250 will be paid to aged pensioners, veterans and eligible concession card holders – one payment in November 2020 and the other in early 2021.

Capital gains tax exemption for granny flat arrangements

From 1 July 2021 capital gains tax (CGT) will no longer apply if building a granny flat for elderly Australian or those with disabilities. A side benefit here is it should encourage granny flat tenants to enter formal written arrangements which provide them protection in the event of a family or relationship breakdown and reduce the risk of financial abuse.

Aged care support for older Australians

From 2020/21 the Government will provide 23,000 additional home care packages across all package level. This will reduce the waiting time for the 100,000 older Australians waiting for their packages to be funded.

The Commonwealth Continuity of Support Programme will be replaced with a new ‘Disability Support for Older Australians’. This will allow older disabled Australians who are ineligible for the ‘National Disability Insurance Scheme’ to receive continued support.

Businesses

JobMaker

Eligible employers will receive a hiring credit for each newly created position as follows:

* Tier 1: $200 per week for each eligible employee hired aged 16 to 29 years, and/or

* Tier 2: $100 per week for each eligible employee hired aged 30 to 35 years

The JobMaker Hiring Credit will be available for up to 12 months from the date of employment of the eligible employee. To be eligible for the JobMaker Hiring Credit, the employer cannot be receiving any other Commonwealth wage subsidy program for the same employee.

Eligible Employees

To be an eligible employee, the employee must:

> have worked at least 20 paid hours per week on average for the full weeks they were employed over the reporting period

> commenced their employment between 7 October 2020 and 6 October 2021

> have received the JobSeeker Payment, Youth Allowance (Other), or Parenting Payment for at least one month within the past three months before they were hired

> be in their first year of employment with this employer, reflecting that the hiring credit is only available for 12 months for each additional job, and

> must be employed for the period that the employer is claiming for them. Employees may be employed on a permanent, casual or fixed term basis.

JobMaker plan — boosting apprenticeships wage subsidy

From 5 October 2020 to 30 September 2021, businesses of any size can claim the new boosting apprentices wage subsidy for new apprentices or trainees who commence during this period.

Eligible businesses will be reimbursed up to 50% of an apprentice or trainee’s wages worth up to $7,000 per quarter, capped at 100,000 places.

Full deduction for capital asset expenditure (‘Instant asset write-off’)

Businesses with an aggregated turnover of less than $5 billion can deduct the full cost of eligible capital assets acquired from 6 October 2020 that are first used or installed by 30 June 2022.

Businesses with an aggregated annual turnover of less than $10 million can deduct the balance of their simplified depreciation pool at the end of the income year while full expensing applies. The provisions which prevent small businesses from re-entering the simplified depreciation regime for five years if they opt-out will continue to be suspended.

Carry back tax losses

Eligible companies can carry back tax losses from the 2019/20, 2020/21 and 2021/22 financial years to offset previously taxed profits in the 2018/19 or later financial years. This will generate a refundable tax offset in the year in which the loss is made. Companies with an aggregated turnover of less than $5 billion are eligible.

The amount carried back cannot exceed the earlier taxed profits and the carry back amount cannot generate a franking account deficit.

The bottom line?

They have had a swing. In arguably the most anticipated Budgets’ of our time this Budget is pro-business and pro low/middle income earner. The crux of it is getting back on with it and weening the economy off unsustainable welfare (JobKeeper) into policies that promote and support job creation (JobMaker).

JobMaker, apprenticeships and instant asset write offs boost the cash flow of many firms and encourages employment and bringing forward personal income tax cuts puts cash in many individual and family hands that in turn is spent within the economy.

Time will tell if the extra cash has the multiplier effect the Government is clearly seeking however it is a good start.

If you have any questions as to how this budget impacts you and your loved ones, please contact us directly or do not hesitate to reach out for a virtual coffee.