It is never too late to start retirement planning to manage your finances better. A 45-year-old can contribute thousands of dollars easily each year contributing a significant benefit to their retirement by using salary sacrificing.

How Salary Sacrifice Can Help You Save on Tax and Grow Your Wealth

One of the best ways to grow your wealth is by putting a little extra into your super each pay before you’re taxed. This is known as salary sacrifice. When you add extra into your super, your money will generally be taxed at 15%.

For most people, this will be much less than your marginal rate, which could be as high as 47%.

When you salary sacrifice super contributions, they are counted toward concessional before-tax contributions, capped at $27,500 per year. The benefit is two-fold; your future self benefits from the additional money saved, and the effect of compounding any returns on your super will boost your balance even more.

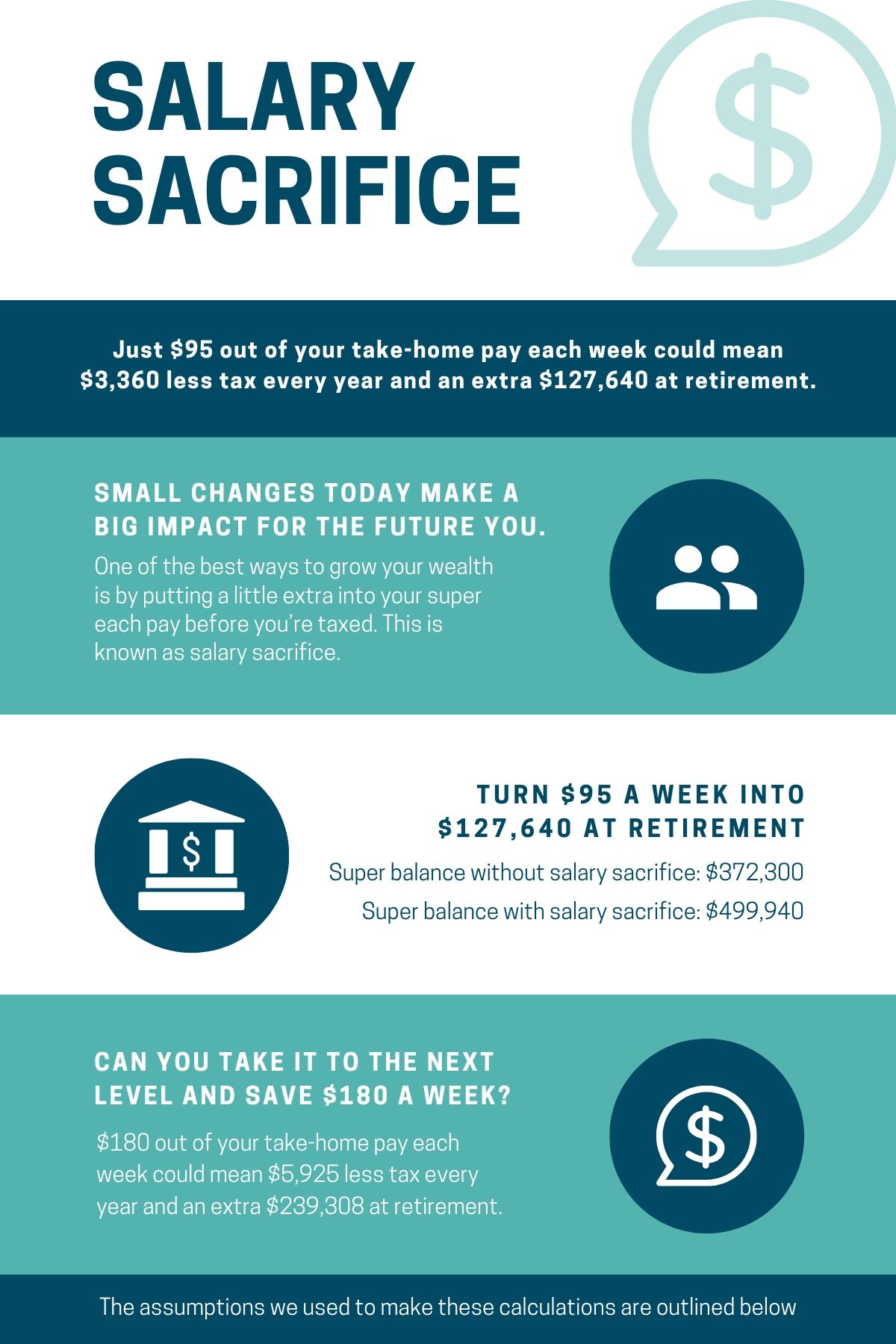

How salary sacrifice could give you an extra $127,640

Just $95 out of your take-home pay each week could mean $3,360 less tax every year and an extra $127,640 at retirement.

Can you save $180 a week instead? Saving $180 out of your take-home pay each week could mean $5,925 less tax every year and an extra $239,308 at retirement.

Peter Stevens, Financial Planner at Forrest Private Wealth says, “Never underestimate how small changes today can make a big impact for the future You.” It’s important to note that accumulated contributions will be preserved until retirement or upon meeting conditions of release.

Start enjoying more of super’s benefits today.

Continue reading to learn more about the assumptions we used for the calculations and as always, if you have any questions, please don’t hesitate to get in touch.

Calculation assumptions

The highest marginal tax rate is 45% plus 2% Medicare levy. Concessional contributions such as salary sacrifice are generally taxed at 15% when received by your fund. However, a higher rate of tax may be payable on part or all of these contributions if your income and before-tax contributions are more than $250,000 in a financial year.

Concessional (pre-tax) contributions are limited to a cap of $27,500 in a financial year, with additional tax applying for contributions in excess of this cap. Concessional contributions include employer super guarantee payments, salary sacrifice super contributions and any personal contributions for which you claim a tax-deduction. Unused concessional cap carry forward: If you haven’t reached your concessional contributions cap during a financial year, you may be able to carry forward unused cap amounts to use in future years. Access to these unused cap amounts applies from 1 July 2019 and is limited to people with a total superannuation balance less than $500,000 and to unused amounts from the previous five financial years (starting from 1 July 2018).

Assumptions: Projection starts at 1 July 2019; current age is 45 and retirement age is 65; current superannuation balance is $150,000; current annual salary is $100,000; annual salary has a marginal tax rate of 37% + 2% Medicare levy (low income/low and middle income tax offsets apply); salary sacrifice calculated as 8% of gross salary rounded to nearest $5 per week; 15% contributions tax applies to pre-tax contributions; salary growth rate of 1% p.a. and employer super guarantee contributions of 9.5% p.a. (increasing gradually to 12% in line with legislation); investment rate of return based on an earning rate of 3% income and 2% growth (Total 5%) p.a. compounded yearly net of tax; results in today’s dollars discounted by CPI inflation of 3% p.a.

Forrest Private Wealth – Financial Advice Perth

Forrest Private Wealth Pty Ltd ABN 12 615 181 881 (Forrest), a corporate authorised representative of Forrest Private Wealth Management Pty Ltd ABN 18 615 339 485, AFSL 492712, is a privately-owned financial advice business. Forrest provides wealth management solutions that includes financial planning, asset management, retirement planning, and investment advice. This document may include general advice but does not take into account your individual objectives, financial situation or needs. You should read Forrest’s Financial Services Guide (FSG) carefully, assess whether the information is appropriate for you, and consider talking to one of our financial planners before making an investment decision. Our FSG can be obtained by calling us on 9382 1866.

Taxation considerations are general and based on present taxation laws and may be subject to change. You should seek independent, professional tax advice before making any decision based on this information. Forrest is a registered tax (financial) adviser under the Tax Agent Services Act 2009. You should seek tax advice from a registered tax agent or a registered tax (financial) adviser if you intend to rely on this information to satisfy the liabilities or obligations or claim entitlements that arise, or could arise, under a taxation law.