Brunch with the gang is fun. Budgeting and planning your financial future is, well… not quite as fun. It has become all too popular for a whole generation to head out regularly for breakfast and get a daily takeaway coffee (or two!). At around $25 a brekkie (let’s go with 2 a week) and a minimum of 5 weekly coffees at $5 a pop we are talking $75 a week for an avo and caffeine fix. Can $75 a week really make a difference in an investment and financial planning strategy?

Let’s start with a simple question: what else could we be using that $75 a week on to improve our lives? Let’s get the low down from the financial planner team at Forrest Private Wealth and find out exactly how much the little indulgences can cost in the long run.

Paying off debt

If you have a credit card, this is will likely be your loan with the highest interest rate and the top priority to pay off. With rates being around 13-20% depending on the provider, you’ll be paying at least $130 extra per annum for every $1000 you have on the credit card. Credit cards are not a bad thing, however your monthly budget/cash flow should not be relying on a credit card. If it is, you need to tighten up spending as a credit card should be paid off monthly, accruing no interest payments.

Car loans are also a priority to pay off, with rates ranging from around 7-15%. Remember that a car will lose value as soon as it leaves the showroom. A flashy car in your 20s is a bad financial investment. Don’t get caught up in what others are doing, do what’s right for your overall financial planning strategy.

Paying down mortgage

If you have a mortgage, overpaying the loan (if it allows without penalty) is a great way to cut years of the mortgage. Let’s work an example:

A $300,000 loan at 4.5% for 30 years = a monthly repayment of $1520.06 per month.

If we take our $75 avo and coffee weekly spend and pay off an extra $325 per month, we will save a whopping 9 years off the total loan period. $75 a week really doesn’t seem like much yet with large sums incurring interest over a long period of time, a big impact can be made.

Investment Portfolio

If high rate loans are paid off, an investment portfolio should be considered as part of your wider financial planning strategy. The kind of investment portfolio that is suitable for you will depend on a number of factors, including your overall financial goals and attitude towards risk. Investment advice is highly personalised to suit your situation and goals.

Compound Interest / Inflation

Don’t forget the power of compound interest and inflation. With Australia’s inflation rate currently sitting at about 2%, your money needs to making at least 2% just to be worth the same amount next year as it is now.

Any top financial planners will tell you that compound interest is your best friend. Compound interest is interest paid on the initial principal as well as the accumulated interest on money you have invested. Compound interest is different from simple interest.

Simple interest is like getting an extra poached egg on your avo on toast now and compound interest is like getting the poached egg plus feta, sundried tomato, hummus pesto and a side of bacon later down the track.

Let’s work an example. If you start with $10,000 invested for 10 years at 10% per year, with interest paid at the end of the term, you would earn $10,000 in simple interest after 10 years, $1,000 for each year. This would give you a total of $20,000 after 10 years.

If you invested $10,000 for 10 years at 10%, with interest calculated and added monthly, you would earn $17,070 in compound interest after 10 years, giving you a total of $27,070. Returns would be higher because you’d earn interest on the interest.

Compound interest is a powerful thing and money invested in your 20s is much more valuable than money invested in your 40s, even if you invest more in 40s than 20s. Let’s do another example. Let’s say you start with an initial sum of $10,000 and add $300 each month, from age 25 to 65 (40 years). With an interest rate of 5% and the compound frequency monthly, at age 65 you’d have $531,390. See below:

*Source: https://www.moneysmart.gov.au/tools-and-resources/calculators-and-apps/compound-interest-calculator

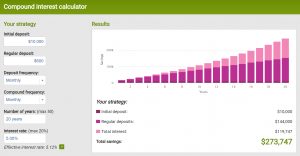

But let’s say at age 45 to 65 (20 years) you also start with $10,000 but add $600 per month (double) to catch up on lost time. With an interest rate of 5% and the compound frequency monthly, at age 65 you’d have only $273,747. See below:

*Source: https://www.moneysmart.gov.au/tools-and-resources/calculators-and-apps/compound-interest-calculator

As you can see, despite contributing $144,000 in regular deposits in both scenarios, the person who starts in their 20s benefits far greatly. This is the power of compounding. Both these scenarios can be improved by using more tax effective means like salary sacrificing into superannuation.

So, now do we know how much these indulgences cost in the long run?

If you have any questions about any topics covered in this article, please get in touch with the financial planner team at Forrest Private Wealth.

Now… brunch anyone?!