On Tuesday, 21 July 2020, the Federal Government released a range of proposals to the JobKeeper and JobSeeker Payments to effectively extend the schemes for a further six months until 28 March 2020.

JobKeeper key points

Here’s what you need to know:

- Existing rules will continue to apply as originally introduced until 27 September 2020.

- New extension increases JobKeeper by 6 months from 28 September to 28 March 2021.

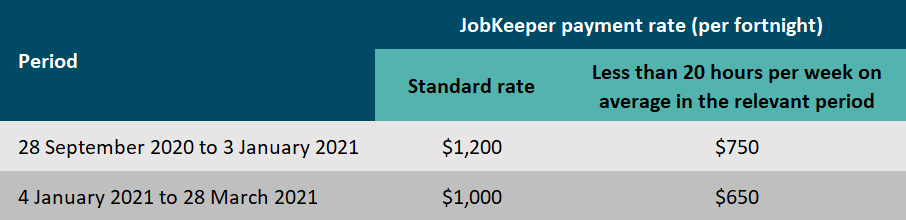

- New payment rates to apply over two periods from 28 September and 4 January 2021.

- Decline in turnover tests for eligible businesses and not-for-profits to be based on actual rather than projected turnover from 28 September.

- Existing $1,500 per fortnight JobKeeper rate to continue to be paid to eligible recipients until the original end date of 27 September 2020.

- Legislation is necessary to support this measure and the next sitting of Parliament is 24 August 2020

JobKeeper payment rate

Currently, JobKeeper is a flat rate of $1,500 per fortnight ending 27 September 2020. The extension of JobKeeper until 28 March 2021 will have two rates with lower payment rates applying to employees (and eligible business participants) who have worked less than 20 hours per week on average, in the four weekly pay periods before 1 March 2020 (or the month of February 2020 for eligible business participants).

Turnover test for extended JobKeeper Payment from 28 September 2020

Businesses and not-for-profits will need to reassess their eligibility for the JobKeeper Payment by demonstrating they have suffered an ongoing significant decline in turnover using actual GST turnover (rather than projected GST turnover). Other eligibility rules for businesses and not-for-profits and their employees remain unchanged.

To recap, the decline in turnover is:

- 50% for businesses with aggregated turnover of more than $1 billion

- 30% for business with aggregated turnover of $1 billion or less, or

- 15% for Australian charities and not-for-profit commission-registered charities (excluding schools and universities).

The ATO may assess eligibility using information provided in business activity statements, instalment activity statements, tax returns and single touch payroll systems.

The decline in turnover thresholds are unchanged, however, turnover assessment will be specifically measured at two points under the extension:

– 28 September 2020 to 3 January 2021 (first testing period)

Businesses will need to have a significant fall in actual GST turnover in the June and September 2020 quarters compared to the corresponding quarters in 2019.

– 4 January to 28 March 2021 (second testing period)

Businesses will need to have a significant fall in actual GST turnover in the June, September and December 2020 quarters compared to the corresponding quarters in 2019.

The ATO will have discretion to provide alternative methods to determine turnover including circumstances where it is not appropriate to compare actual turnover in 2020 with corresponding quarter in 2019. This is consistent with the current discretion provided to the ATO.

Coronavirus key points:

Extended and reduced Coronavirus Supplement

- Coronavirus Supplement extended to 31 December 2020.

- From 25 September 2020 the supplement amount will reduce from $550 to $250 per fortnight.

- Eligibility criteria for the Coronavirus Supplement remains the same.

- Changes to the JobKeeper Payment may make recipients of that payment eligible for the JobSeeker Payment.

Adjustments to the JobSeeker Payment income test – 25 September to 31 December

Personal Income test

- The income free area for JobSeeker Payment recipients will increase from $106 per fortnight to $300 per fortnight. This means recipients may receive income up to $300 per fortnight without any reduction in JobSeeker Payment.

- Under the income test, every dollar received over $300 per fortnight will reduce JobSeeker Payment by 60 cents. Currently the JobSeeker Payment is reduced by 50 cents for every dollar received between $106 and $250 per fortnight and by 60 cents thereafter.

- Recipients for any JobSeeker Payment receive the FULL Coronavirus Supplement.

Partner Income Test

- The reduction rate under the Partner Income Test will increase from 25 cents to 27 cents.

- Partners of JobSeeker Payment recipients may receive up to $3,086.11 per fortnight or $80,238.89 per annum before the JobSeeker Payment cuts out.

Asset Test and Liquid Asset Waiting Period to be reinstated and apply from 25 September 2020

- The Asset Test will apply from 25 September 2020. For example, single homeowners with assessable assets of $268,000 or more will not be eligible for JobSeeker Payment. Partnered homeowners may have up to $401,500 in combined assessable assets.

- The Liquid Asset Waiting Period (LAWP) of up to 13 weeks will be reinstated and the Income Maintenance Period (IMP) will continue.

- The Ordinary Waiting Period, Newly Arrived Resident’s Waiting Period (NARWP) and the Seasonal Work Preclusion Period will continue to be waived until 31 December 2020.

We’re here to help

If you, or someone you know, has any of your any further questions, please feel free to reach out to us or arrange a virtual coffee.